Pay bands - or pay scales - are part of an organisation's Compensation & Benefits' policies and practices - forming part of a wider HR strategy. They define the company's willingness to pay for certain jobs of equal value, serving as a decision-making tool for determining the salary levels of individual employees - as well as objectifying and legitimising decisions to various stakeholders.

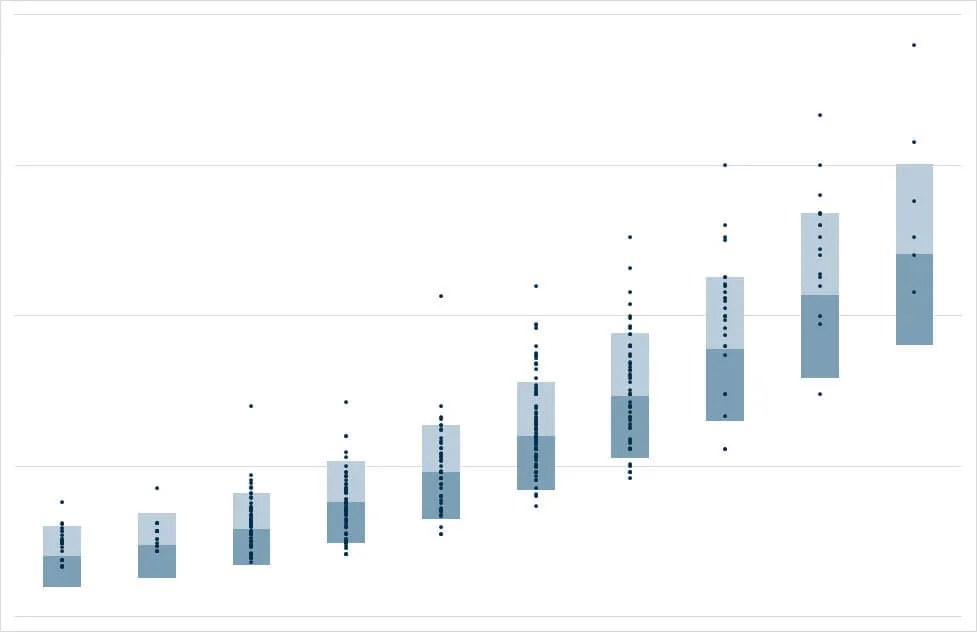

Range of pay bands

The height and range of pay bands depend on how much the company is willing to pay. This can be dependent on a number of factors, such as their revenue situation, the labour market, the internal remuneration situation, salary benchmarks, remuneration strategy - the list goes on.

In many companies, the remuneration practice not only depends on the willingness to pay but is the result of collective agreements influenced by several interest groups like labour unions or employer’s associations. A higher willingness to pay may be seen through over-tariff allowances and a lower willingness to pay in exempting an organisation from collective bargaining agreements.

Pay band design

Typically, a pay band is modelled around a midpoint. The minimum and maximum of the range are derived symmetrically (+/- 20%) or asymmetrically, (-10% / +20%) dependent on the overall remuneration strategy of the company. Ideally, pay bands are coupled to grades from an analytical job evaluation or company-specific levels.

The height of the midpoint depends on the distribution of the actual salaries within each grade and a defined percentile from a benchmark - such as the median. It generally follows the company's remuneration strategy.

Base Pay plus Variable Pay compared to TTC and its Pay Mix

What is a Pay Mix?

A pay mix is the ratio of Base Pay to Variable Pay in a compensation structure. The pay mix is represented as a percentage split of Total Target Compensation (TTC), also known as On-Target Earnings (OTE).

The first number represents the Base Pay and the second number represents the Variable Pay / Incentive Pay amount as a target value - assuming 100% target achievement.

For example, an 80/20 pay mix means that 80% of TTC is fixed base salary and 20% of TTC is variable pay. The two numbers represented by pay mix will always equal 100% when added together. A different representation of this pay mix would be base pay plus 25% variable pay, because 20 units of 80 units are one quarter or 25%.

What is Base Pay plus Variable Pay?

Variable pay schemes provide cash payments to employees that are related to the performance of their organisation, their team or themselves. It’s often the sole method of providing employees with rewards in addition to their base pay. A defining characteristic of variable pay is that it has to be re-earned, unlike salary increases and merit adjustments.

In our experience, many employees take a 100% payout of variable pay in a pay mix for granted. But when variable pay is offered on top of base pay, it’s usually seen as an incentive which is at risk of not being achieved if they don’t perform to a high enough level.

To determine an organization’s optimal split of base pay and variable pay is part of discussing and setting a compensation philosophy. The relative amount of variable pay varies by job requirements and - as a general rule - the greater the requirements and impact of a job, the greater the variable component in a compensation structure.

Updating and Aging of Pay Bands

External market pay rates are constantly changing with supply and demand, inflation, changes in pay tables of labor agreements, the rise of new job profiles and fall of outdated profiles.

One way to update and age pay bands is to use information on annual changes of consumer prices. These, together with inflation forecasts, are published by national offices for statistics or organizations such as the IMF in its Economic Outlook, OECD and Worldbank.

Some of these organizations also provide information on employment costs, including wages, salaries and the employer's cost of employee benefits and social security.

Another option is to participate in salary budget & compensation planning surveys that provide information on salary increase budgets. Our colleagues at Culpepper run a Global Salary Budget & Compensation Planning Survey and analyze information on base salary increases, salary range structure adjustments, promotional increases, variable pay budgets, salary budgeting practices, human capital expense strategies and total rewards strategies. And participation is free, as of January 2020!

In mature markets with low inflation, we would recommend analyzing compensation structures in detail every two to three years. This makes sure the appropriate adjustments can then be made to the organization's pay bands. This information can also be used to determine salary increase budgets for individuals’ salary and merit increases.

Employee remuneration within pay bands

The remuneration of employees is oriented:

- On an individual level after delivering performance, engagement and employee potential

- After the claim to internal equality when comparing the remuneration of colleagues with similar activities and comparable performance

- On the level of the market after the income of other company's employees in comparable positions

Within the pay bands, the individual salaries of the employees are negotiated. In contrast to defined salary groups used in collective agreements, pay bands allow for a certain flexibility of the salary calculation.

This typically comes with a heterogeneous salary development over time, oriented after internal factors like engagement, performance and employee potential, as well as external factors like inflation, market growth and labour agreement regulations.

Since performance is especially difficult to measure, a performance rating often reflects the subjective evaluation of the responsible manager. As a result, HR plays a major role in reward management as a cross-divisional moderator and during salary adjustment negotiations.

Pay equity and differentiation

Pay equity plays a central role from a motivation theory perspective. Distributive justice (the same pay for the same work) is ensured when an employee’s salary - from their perspective - corresponds to the salary of comparable colleagues. Procedural justice of remuneration is ensured when the criteria of pay differentiation are transparent and the individual assessment of merit increases is comprehensible.

In most European companies, the introduction of pay bands is governed between employer and employee representatives as part of a company agreement. In such an agreement, it’s crucial to regulate procedural issues of compensation management and deal with outliers above the maximum and below the minimum of the pay bands.

Would you like to know more?

register now for our free evaluation version and try gradar for free!